Image by Tad Hanna from Pixabay

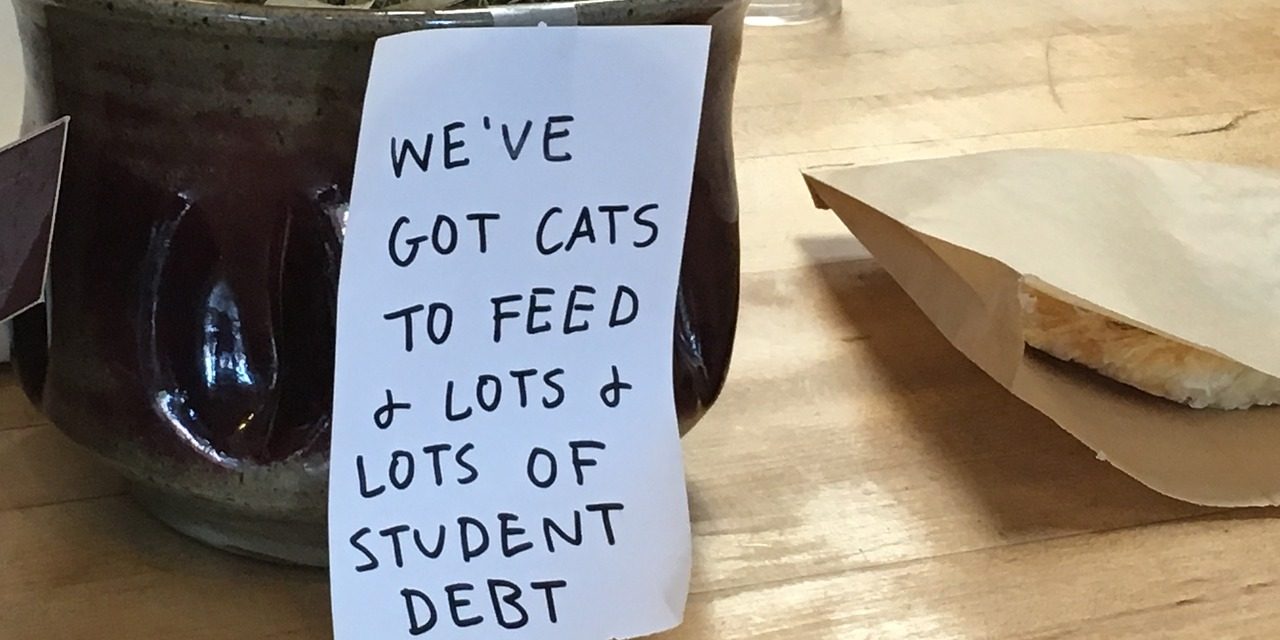

If you’re a student-loan borrower, chances are you’ve been victimized.

Published reports indicate 25 percent of student borrowers either are in default or are having difficulty making payments because they couldn’t get good-paying jobs after college.

If this includes you, you’ve probably had one or more of a potpourri of complaints.

For example, your payments have been mishandled, you were given erroneous information, had cash flow issues and couldn’t lower your payment, or were over-charged on fees.

After apparent predatory behavior by Sallie Mae, which is now Navient, the student loan company was forced into a $97 million settlement in May 2014 after being charged with cheating members of the military.

The breakdown:

— Sallie Mae settled with the U.S. Justice Department for $60 million for over-charging service members above 6 percent and then getting financial judgments against them — such predatory behavior is a violation of federal law.

— Sallie Mae was also forced to pay $30 million in restitution for bogus late fee charges and $6.6 million in civil penalties.

If you’ve had a student loan via Sallie Mae, chances are you’ve known the pain of trying to repay it.

You’ve got a fine education, but you’re not yet making enough money to pay it off. Or if you weren’t able to graduate, you’re not earning enough money to pay off your debt.

Also, your monthly payment isn’t enough to pay down the principal – it just goes toward the compounding interest.

So your total student loan debt is mounting – not decreasing.

This also complicates your finances – it hurts your credit score, which hinders your ability to buy a car or house.

Because private student loans are contingent on credit scores, it also likely prevents getting a private loan refinance.

Worse, the emotional roller coaster hurts your career. If your career is stalled, it’s hard to concentrate on turbo-charging your personal brand.

If you own a business, the stress makes it’s difficult to keep your business dreams alive.

Or, if you need to cut costs, it’s hard to avoid making reactionary decisions.

Whatever your situation, it might not be much consolation in your student loan agony, but here goes – you’re not alone.

Published reports indicate the aggregate student loan debt has ballooned to more than $1.4 trillion for 44 million borrowers. Millions of Americans are in default of their loans.

In fact, the overall student-loan debt is now higher than credit-card debt. For many Americans who have defaulted, their wages are being garnished and their federal tax refunds are required to repay their student loans.

For many Americans who have defaulted, their wages are being garnished and their federal tax refunds are required to repay their student loans.

Solutions

So, how can you get out of this financial quicksand?

For many people, a student loan refinance or consolidation are the solutions. Borrowers are able to lock in a cheaper fixed interest rate. Some try extending the life term of their loans, but all that accomplishes is more overall debt.

Consolidation means you’ll simplify your life because you’ll only make one monthly payment. But again, it’s likely that you’ll be reducing your monthly payment, but resetting the term of the loan.

Also, don’t refinance or consolidate if you have a federal Perkins loan. Why? They’re likely the most inexpensive you can get. The Perkins loans aid low-income students in getting a post-secondary education.

Obviously, don’t refinance or consolidate, if you can’t get a better deal.

So here are the five options:

1. Check with your lender about a consolidation deal. Some lenders might want to keep your business for the long term. They don’t want to lose potentially good customers to their competitors.

Note, however, private-loan refinancing is applicable for private student loans, only. Therefore, it isn’t for federal student loans. Nor can you combine a refinance for private and federal student loans.

2. See your local community bank. If the community banker can’t help you, they’ll probably give you some ideas.

3. If you can qualify for private loan consolidation, here are a couple of lenders –

The criteria varies so ask the right questions:

— Can I pay by debit or credit card without incurring a fee?

— Would I be paying a fixed or variable interest rate?

— Would I have to pay fees?

— Would I be subject to pre-payment penalties?

— What is the discount if I make automatic payments from my checking account?

— What are the discounts for on-time payments?

4. Try one of the more than 130 credit unions in cuStudentLoans for a consolidation. Credit unions are nonprofit lenders, which mean you’ll probably enjoy the prospect of a lower rate and overall better deal.

From the Coach’s Corner, here are additional tips:

What the Affluent Know about Achieving Financial Success — Two different experts who speak with authority about wealthy Americans – a business professor and a leading consulting firm – have offered advice for minorities who seek success in their careers.

For Best Results to Get Wealth and High Net Worth, 7 Steps — Creating wealth and enjoying high net worth doesn’t result from pure luck. It takes a certain mindset and strong action. Here are seven proven steps.

Money – Your Net Worth Matters More than What You Earn — When it comes to finance, most business owners and other individuals strive to increase their wealth to have more opportunities. The trouble with some, however, is that they focus on income and not their net worth. That means, of course, spending less than they earn.

Worrying does not take away tomorrow’s troubles, it takes away today’s peace.

__________