You’re not alone if you’re drowning in student-loan debt. The average college graduate in 2015 was saddled with student loans totaling $35,000, which takes 10 to 20 years to pay off.

Why?

Many grads get a good job but it simply isn’t enough for debt-service of student loans.

Others make the mistake of paying the minimum amount each month because they’re unemployed, under-employed or they’re otherwise squeezed by debt from poor choices.

Whatever your situation, you’ll end up paying far more than the loan amount.

By only making minimum payments, you’re extending the life of your intended debt because of compounding interest which adds to the principal.

This hurts your credit rating, which hurts your ability to buy a home or achieve other financial goals.

It’s imperative to strategize how to pay it off as soon as you can. Create a detailed budget that will enable you to do it.

Depending on the amount of your student-loan debt and your income, it might take you more than a year to eliminate it. But one to three years of thrifty behavior is worth it. You’ll be a lot happier in the long run.

Creating wealth and high net worth doesn’t result from pure luck. It takes a certain mindset and strong action.

So set a goal to save thousands of dollars by shortening the life of the debt.

Here are eight tips:

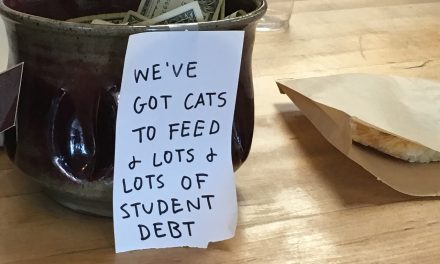

1. Make it a game to economize

Develop a minimalist philosophy. The trouble with many debt-ridden Millennials is they want to buy the latest in technology, a bigger TV set or to eat out a lot.

Resist buying. When tempted to spend money, ask yourself: “Do I really NEED this?” Change your habits. Unsubscribe from daily retail ads so you’re not tempted for what is now wasted spending for you.

Economize in every way possible and pay down your student loans. Treat it as an adventure. The short-term pain of austerity will result in a long-term gain.

While you’re at it, learn all you can about finance and getting ahead financially. Creating wealth and high net worth doesn’t result from pure luck. It takes a certain mindset and strong action.

2. Research employers that offer student-loan payment incentives

Believe or not, there are employers, including in the public sector, that offer student loan assistance. They do it as a perk to recruit Millennial employees.

3. Find a second job

While you’re young, it’s much easier to work long hours. So take a part-time job or take advantage of overtime opportunities.

There was a period after college when I forced myself to work 83 hours a week at two jobs and I fondly look back with immense self-satisfaction. In boxing vernacular, I was glad I “answered the bell” to meet the challenge.

4. Inquire about payroll allotments

Some companies will help you with a payroll allotment program. Talk with your human resources department. Explain your objective.

By arranging for a portion of your paycheck to go into another account – not your personal checking or savings accounts – you won’t spend the money because you’ll never see it.

5. Temporarily abstain from your employer’s 401(k)

True, saving and investing is important. But it’s more important for you to eliminate all debt ASAP. You’ll prosper faster if you first pay the debt to avoid the hazards of compounding interest.

6. Get a lower cost-living arrangement

This is all about debt-servicing. Be disciplined. Pay as little rent as possible and share utility costs. Get a roommate. Consider moving back home. Your parents are likely to agree. Remind yourself it’s only temporary.

7. Take advantage of your digital skills to sell online

If you’re like most Americans, you probably have possessions you no longer use. Many might be valuable to someone else. So leverage Amazon or eBay.

While you’re at it, see if you can avoid driving a car. Consider selling it. Think about the high costs of car payment, fuel, insurance and maintenance. Consider alternatives in carpooling, rideshare options or public transportation.

8. Study and work to advance into management

If you’re stuck in a low-paying job and you’re ambitious, organize internal and external self-marketing campaigns to advance into management.

If you can master seven core competencies, it’s possible you’ll position yourself to become a young CEO.

After you’re successful, you’re not done. Stay focused on the prize. Pay down that debt. Make it a lifelong commitment to live as frugally as possible and continue to learn.

From the Coach’s Corner, here are links to relevant Biz Coach articles:

5 Solutions to Ease the Pain of Your Student Loan Debt — After more apparent predatory behavior by Sallie Mae — the student loan company was forced into a $97 million settlement in May 2014 after being charged with cheating members of the military. The breakdown: Sallie Mae settled with the U.S. Justice Department for $60 million for over-charging service members above 6 percent and then getting financial judgments against them — such predatory behavior is a violation of federal law.

Debt Consolidation Will Sink You without These 6 Tips — If you’re not careful in your debt-consolidation plan to bundle your debts for a lower interest rate and minimum payments, you might get into more financial problems. Here are six precautions.

“You can’t be in debt and win. It doesn’t work.”

-Dave Ramsey

__________